Recent developments keep Gilead ahead of the pack in HIV treatment market, says GlobalData Analyst

Posted: 8 October 2014 | | No comments yet

Gilead’s announcement of positive Phase III results for its investigational single-tablet regimen (STR), elvitegravir/cobicistat/emtricitabine/tenofovir alafenamide fumarate (TAF), caps a series of developments bolstering the company’s position as HIV treatment market leader…

Gilead’s announcement of positive Phase III results for its investigational single-tablet regimen (STR), elvitegravir/cobicistat/emtricitabine/tenofovir alafenamide fumarate (TAF), caps a series of developments bolstering the company’s position as HIV treatment market leader, according to an analyst with research and consulting firm GlobalData.

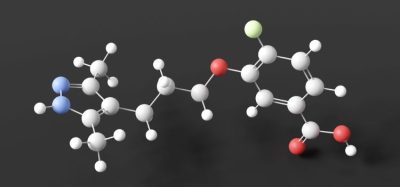

Gilead recently declared that its new drug, an update of Stribild in which tenofovir disoproxil fumarate (TDF) is substituted with TAF, displayed non-inferior virologic efficacy, as well as improved renal and bone tolerability, compared with its predecessor in Phase III clinical trials.

Moritz Herrmann, Ph.D., GlobalData’s Analyst covering Infectious Diseases, says that these results indicate that Gilead’s new STR could compete strongly against ViiV’s recently-approved STR, Triumeq.

Herrmann comments: “Triumeq threatens Gilead’s long-standing dominance in the single-tablet, once-daily, anti-HIV market, as it is the first non-Gilead STR, and also the first regimen to show virologic superiority over Gilead’s Atripla.

“With these new Phase III results, Gilead can effectively address safety concerns surrounding the renal and bone tolerability of its TDF-containing STRs. This positive development is particularly significant given the size of this market, in which Atripla generated sales of over $3.6 billion in 2013.”

Additionally, the US Food and Drug Administration (FDA) has approved stand-alone antiretroviral agents Tybost and Vitekta, two of Stribild’s components, but has prohibited their co-administration.

Herrmann continues: “There are no clinical or pharmacokinetic data on combinations of either drug as a stand-alone treatment, meaning that Gilead will be unable to foster the uptake of Tybost as an individual agent.

“While the FDA approvals of Tybost and Vitekta will open up some new revenue streams to Gilead’s diverse antiretroviral portfolio, the uptake of these drugs will be limited by the current market landscape and regulatory decisions.”

Janssen’s Rezolsta is currently being developed under a licensing agreement with Gilead for Tybost to treat adult HIV-1 patients in combination with other antiretroviral agents. Herrmann concludes that the positive opinion of Europe’s Committee for Medicinal Products for Human Use towards Rezolsta will further strengthen Gilead’s HIV market position.