Gilead Sciences to acquire Immunomedics for $21 billion

Posted: 17 September 2020 | Victoria Rees (European Pharmaceutical Review) | No comments yet

Gilead is set to acquire Immunomedics for approximately $21 billion, with the transaction anticipated to close in the fourth quarter of 2020.

Gilead Sciences has announced it has acquired Immunomedics for approximately $21 billion, at $88 per share in cash. The transaction is anticipated to close during the fourth quarter of 2020.

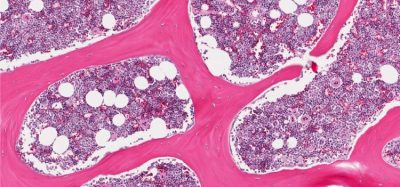

The agreement will provide Gilead with TrodelvyTM (sacituzumab govitecan-hziy), a first-in-class Trop-2 directed antibody-drug conjugate (ADC) that was granted accelerated approval by the US Food and Drug Administration (FDA) for the treatment of adult patients with metastatic triple-negative breast cancer (mTNBC).

Immunomedics plans to submit a supplemental Biologics License Application (BLA) to support full approval of Trodelvy in the US in the fourth quarter of 2020.

“This acquisition represents significant progress in Gilead’s work to build a strong and diverse oncology portfolio. Trodelvy is an approved, transformational medicine for a form of cancer that is particularly challenging to treat. We will now continue to explore its potential to treat many other types of cancer, both as a monotherapy and in combination with other treatments,” said Daniel O’Day, Chairman and Chief Executive Officer of Gilead Sciences. “We look forward to welcoming the talented Immunomedics team to Gilead so we can continue to advance this important new medicine for the benefit of patients with cancer worldwide.”

“We are very pleased that Gilead recognised the value of Trodelvy – both for the important role it has already begun to play for patients with mTNBC and for its potential to help many other patients with cancer in the future,” said Dr Behzad Aghazadeh, Executive Chairman of Immunomedics. “We are excited for the opportunities ahead of us as we join with Gilead to advance our shared mission in defeating cancer. By working with Gilead, we have the opportunity to accelerate our progress and improve care for patients in need of new therapies.”

The tender offer is not subject to a financing condition and will be funded through approximately $15 billion in cash on hand, as well as approximately $6 billion in newly issued debt.

Related topics

Related organisations

Gilead Sciences, Immunomedics, US Food and Drug Administration (FDA)