Indian CMO market hotbed for private equity investment, says report

Posted: 17 August 2020 | Victoria Rees (European Pharmaceutical Review) | No comments yet

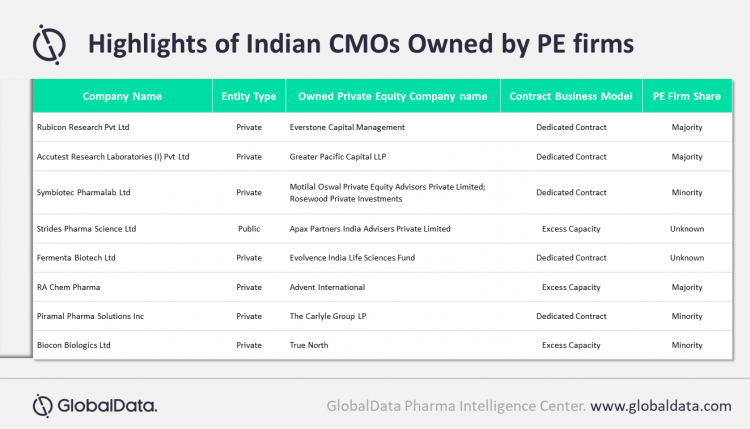

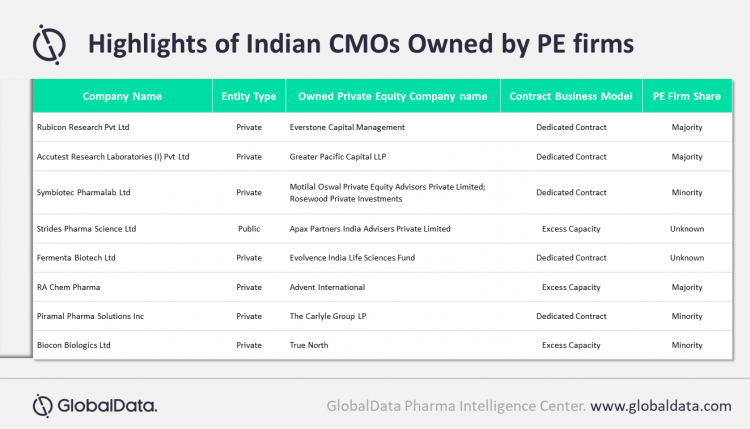

A report suggests that India’s CMO market has recently attracted investment from global private equity firms due to favourable government policies.

A new report that suggested that India’s contract manufacturing organisation (CMO) and pharma market has recently strongly attracted investment from global private equity firms, driven by favourable government policies and a thriving generic drugs market.

According to GlobalData, there are over 1,600 contract manufacturing facilities (across almost 1,000 companies) in India and there is a great deal of potential for private equity investment in the CMO industry.

The outlet says that in July 2020, US-based Advent International agreed to acquire a controlling stake in RA Chem Pharma from its parent Micro Labs for an undisclosed sum and US-based KKR agreed to acquire a 54 percent stake in JB Chemicals & Pharmaceuticals for $611 million. In June 2020, US private equity major Carlyle acquired a 20 percent stake in Piramal Pharma for $490 million. Earlier this year, True North invested $100 million to acquire a 2.44 percent stake in Biocon Biologics.

Piramal previously sold several assets including its healthcare insights and analytics business due to debt issues. With Piramal reporting a consolidated pre-tax loss because of COVID-19, it triggered incremental provisioning in its financial services business in the first quarter of 2020, the report says.

Bhavani Nelavelly, Pharma Analyst at GlobalData, commented: “Both Advent and KKR have a well-established investment history in India and the recent deals reaffirm the growing interest of private equity firms in the Indian pharmaceutical industry. From the Piramal, JB Chemicals and RA Chem deals, it is evident that there are growing opportunities in CMO, complex generics and bulk drug manufacturers.”

The outlet highlights that there are over 700 contract facilities with active pharmaceutical ingredient (API)-chemical manufacturing capabilities, which account for almost half of all Indian contract manufacturing facilities. Despite this capability being the most established in drug manufacturing, it is still attractive to investors considering the rise of private equity deals year-on-year between 2016 and 2018 in both deal number and combined value for chemical APIs.

Nelavelly concluded: “Over the past three years, India has witnessed growth in private equity investments as a result of relaxations offered by the government such as increasing the foreign direct investment (FDI) limit from 49 percent to 74 percent in brownfield pharma ventures. Despite the significant growth in investments, there is still scope for improved pharma regulatory framework in terms of investments and high tax incentives to further attract the investors.”

Related topics

Active Pharmaceutical Ingredient (API), Contract Manufacturing, Drug Manufacturing, Manufacturing, Outsourcing

Related organisations

Advent International, Biocon Biologics, Carlyle, GlobalData, JB Chemicals & Pharmaceuticals, KKR, Micro Labs, Piramal Pharma, RA Chem Pharma, True North