WuXi Biologics proposes spin-off to support bioconjugate development

Posted: 11 July 2023 | Catherine Eckford (European Pharmaceutical Review) | No comments yet

WuXi Biologics proposed spin-off and a separate HKEX listing of its subsidiary WuXi XDC means the company will be able to better capture the fast-growing global bioconjugate market.

Contract research, development, and manufacturing organisation (CRDMO) WuXi Biologics has announced a proposed spin-off and separate listing of its subsidiary WuXi XDC Cayman Inc. (WuXi XDC) on the Main Board of the Hong Kong Stock Exchange (HKEX).

A biologics CRDMO

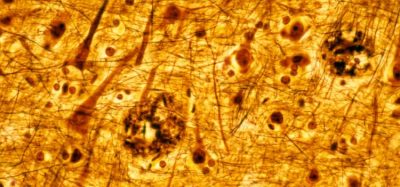

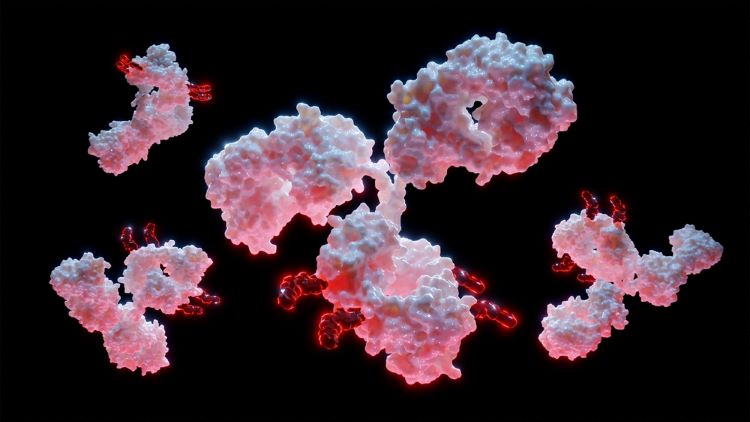

WuXi XDC is a joint venture between WuXi Biologics and WuXi STA. The organisation provides end-to-end contract R&D and manufacturing services for bioconjugates, including antibody drug conjugates (ADCs). Its services cover antibodies and other biologics intermediates, chemical payloads and linkers, as well as bioconjugate drug substances and drug products. It has nearly cut in half the traditional development timeline for bringing multiple ADC projects to the Investigational New Drug (IND) filing stage.

The separate listing “will allow WuXi XDC to serve as an independent platform to fuel and realise its growth potential,” stated Dr Chris Chen, CEO of WuXi Biologics and Chairman of WuXi XDC.

WuXi XDC will remain as a consolidated subsidiary of WuXi Biologics upon completion of the proposed spin-off.

Benefits of the proposed WuXi Biologics spin-off

WuXi XDC will be supported as an independent fundraising platform through the proposed spin-off.

Specifically, it will enable the organisation to solely focus on developing bioconjugates. At first this will be ADCs and evolve to encompass all bioconjugates such as peptide conjugates, oligo conjugates and chemical conjugates (from ADC to XDC).

As some of the opportunities in the fast-growing global bioconjugate market are currently beyond the business scope of WuXi Bio, the proposed spin-off will facilitate the company to capture the market.

The spin-off will allow “WuXi Biologics to continue to focus on our global CRDMO business capabilities, enabling faster, innovative development and manufacturing of biologics,” commented Dr Chen. The company will be able to maintain more flexibility and capacity to allocate funding resources and aid its profitability and long-term growth.

Related topics

Biologics, Biopharmaceuticals, Contract Manufacturing, Contract Research Organisations (CROs), Drug Development, Drug Manufacturing, Industry Insight, Manufacturing, Research & Development (R&D), Therapeutics