Glioblastoma treatment market to increase to $3.3 billion

Posted: 13 January 2016 | | No comments yet

The glioblastoma treatment market will increase fivefold from $659 million in 2014 to $3.3 billion by 2024, according to research and consulting firm GlobalData…

The glioblastoma treatment market will increase fivefold from $659 million in 2014 to $3.3 billion by 2024, according to research and consulting firm GlobalData.

The company’s latest report, OpportunityAnalyzer: Glioblastoma – Opportunity Analysis and Forecast to 2024, states that this meteoric rise in the glioblastoma treatment market, which will occur across the seven major markets of the US, Spain, France, the UK, Italy, Germany and Japan, will primarily be due to the launch of new therapies for glioblastoma patients with high unmet needs.

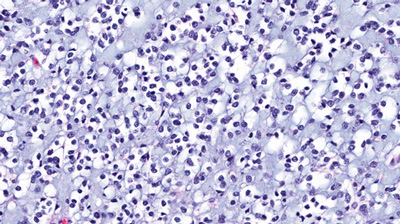

Maxime Bourgognon, PharmD, GlobalData’s Analyst covering Oncology and Haematology, says: “Adults with glioblastoma have some of the highest levels of unmet need of any cancer patients. Despite progress having been made in treating the disease, survival rates remain low.

“Although glioblastoma is a rare disease, such high levels of unmet need in the market have created ample opportunities for players with effective therapies. However, developing drugs which effectively treat glioblastoma has proved exceedingly challenging to date, predominantly due to the presence of the blood-brain barrier, which prevents many drugs from entering the brain and attacking the tumour.”

GlobalData identifies Opdivo as a contender to become standard of care

GlobalData believes that current pipeline drugs offer potential solutions to this complex obstacle, and has identified Bristol-Myers Squibb’s immunotherapy Opdivo (nivolumab) as a particular contender to become the primary standard of care by 2024.

Bourgognon explains: “Immunotherapies have shown significant efficacy in other oncology indications, and as they affect the tumour microenvironment rather than directly targeting the tumour, they make attractive candidates for glioblastoma treatments.

“Currently, Avastin dominates the market, working by inhibiting angiogenesis and disrupting the blood-brain barrier, which in turn leads to tumour starvation. Patients refractory to the drug, however, have scant treatment options, and Opdivo addresses this.”

Of the seven major markets, Japan will see the most impressive relative growth, with sales expanding from $47 million in 2014 to $268 million in 2024, representing a CAGR of 19.7%.

As with the rest of the seven major markets, growth will be driven by the introduction of new drugs such as Opdivo. However, higher pricing of the drug in Japan will result in the country’s even faster growth rate, according to GlobalData.